Multiple Chinese provincial-level regions report H1 GDP growth, bolstering national economic confidence

Over ten Chinese provincial-level regions have released their economic results for the first half of 2025. Despite growing external challenges, some major economic provinces continued to lead the way, while others reported new highlights, building a solid foundation for China's stable GDP growth for the whole year.

As one of the economic powerhouses, East China's Zhejiang Province revealed on Monday that its GDP grew by 5.8 percent year-on-year from January to June, 0.5 percentage points higher than the overall national GDP growth rate during the same period.

The province's value-added industrial output of above-scale enterprises grew by 7.6 percent year-on-year, while that of private enterprises rose by 8 percent, contributing 77.9 percent of the total growth in this sector, according to the local government.

East China's Anhui Province said that first-half economic growth reached 5.6 percent year-on-year. The province's high-tech services investment surged by 21.2 percent year-on-year over the period, maintaining double-digit growth for 12 consecutive months, according to the local government on Monday.

By Monday, at least 11 Chinese provincial-level regions had released their economic data for the first six months, with nine provinces reporting GDP data higher than the national level. Central China's Hubei Province saw its GDP soar by 6.2 percent year-on-year, taking the lead among those provinces in terms of the growth rate, while South China's Guangdong Province saw its total GDP reach 6.87 trillion yuan ($957.8 billion), according to those local governments.

Regional data showed the resilience of China's economy, featuring rapid total GDP growth, stable investment and consumption, as well as increasing vitality in market elements, industrial growth and exports, Cao Heping, an economist at Peking University, told the Global Times on Monday.

As a regional economic powerhouse, Guangdong has maintained stable growth, while other provinces like Hubei, Southwest China's Sichuan, and Central China's Henan have seen sustained economic vitality, Cao said.

"With the building of a unified national market, the supply chain, industrial chain and capital flows across the eastern and central and western regions are accelerating integration. The efficiency and quality of domestic economic circulation continues to rise and the allocation of market elements continues to improve, which provide robust support for China's economic transformation and high-quality development," Cao said, expressing optimism for the country's economic growth in the second half.

According to data released by the National Bureau of Statistics (NBS) on July 15, China's GDP grew 5.3 percent year-on-year in the first half of 2025 and 5.2 percent year-on-year in the second quarter.

Analysts noted that by steadfastly advancing high-quality development and steadily expanding high-level opening-up, the Chinese economy has demonstrated strong resilience, providing a reliable driving force for global economic growth.

"Amid complex global challenges, domestic demand has become the core growth driver for the Chinese economy, with final consumption expenditure contributing 52 percent to GDP growth, while exports achieved 7.2 percent year-on-year growth in the yuan terms through diversified market strategies," An Yun, deputy general manager at Schroders Fund Management, told the Global Times on Monday.

Notably, the cultivation of new quality productive forces yielded substantial results, with the output of high-tech industries recording 9.5 percent growth in the first half, further optimizing the economic structure, An said.

"Given the central government's ample policy reserves, China is expected to achieve its annual GDP growth target of about 5 percent for 2025," he said.

The People's Bank of China (PBC), the country's central bank, said on Monday that the one-year loan prime rate (LPR), a market-based benchmark lending rate, came in at 3 percent, unchanged from the previous month.

The over-five-year LPR, on which many lenders base their mortgage rates, also remained unchanged from the previous reading of 3.5 percent, according to the PBC.

"There is a higher possibility for the PBC to cut reserve requirement ratios and interest rates in the third or fourth quarter this year. The LPR is expected to be lowered accordingly so as to support stable credit expansion," Wen Bin, chief economist at China Minsheng Bank, told the Global Times on Monday.

In addition, the country's fiscal, industrial, and consumption policies will be maintained in the second half of the year to jointly stimulate the supply and demand dynamics, facilitate a moderate recovery of inflation, and gradually smoothen the circulation from production to consumption, Wen said.

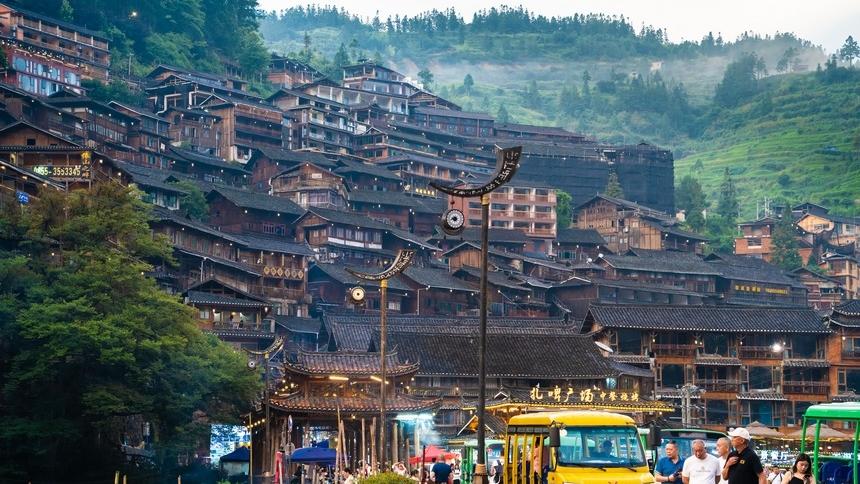

Photos

Related Stories

- China registers 5.3 percent GDP growth in H1 2025, showing strong momentum, resilience

- China's GDP expands 5.3 pct year on year in H1 amid challenges

- China Dynamics: China's GDP expands 5.3 pct year on year in H1

- China's GDP expands 5.3 pct year on year in H1

- Steadiness and?openness:?China's?rising global appeal

- Tariff rollbacks, consumption could lift GDP

- China’s 31 provinces all show positive Q1 GDP growth, laying good foundation for whole-year target, despite headwinds

- China Dynamics: China's GDP grows 5.4% in Q1

- China reports 5.4% GDP growth in Q1 of 2025

- China's GDP expands 5.4 pct year on year in Q1

Copyright © 2025 People's Daily Online. All Rights Reserved.